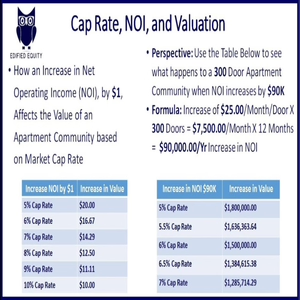

Edified Equity Podcast Episode 48: Cap Rate, NOI, and Valuation

04/02/19 • 8 min

Previous Episode

Edified Equity Podcast Episode 47: Why Workforce Housing CAN Hold off the Blitz of a Recession

Edified Equity Podcast Episode 47: Why Workforce Housing CAN Hold off the Blitz of a Recession Show Notes: Welcome to the Edified Equity Podcast! My Name’s Dino and Here we will focus on all of the unique Benefits associated with being a Passive Equity Investor in an Apartment Syndication. You can learn more about, and follow, us on the Web, iTunes, Stitcher, FB, YouTube, Linkedin, Instagram, & our Award Winning Blog on Bigger Pockets. All associated links will be in the show notes. If you Find this information Helpful Please Subscribe, Like, Comment, Rate & Review! Associated Links! Edified Equity Website: http://www.edifiedequity.com/ Edified Equity Podcast iTunes: https://apple.co/2EUPjvE Edified Equity Podcast Stitcher: http://www.stitcher.com/s?fid=185852&refid=stpr Edified Equity Facebook Group: https://www.facebook.com/groups/MultifamilyPassiveCashFlow// Edified Equity YouTube Channel: https://www.youtube.com/channel/UCiTMeHhVXIMgCujDzXTxkww LinkedIn: http://bit.ly/2EMd0WK Bigger Pockets Blog: https://www.biggerpockets.com/blogs/10726-benefits-multifamily-passive-investors LinkedIn: http://bit.ly/2EMd0WK Edified Equity Podcast Episode 47: Why Workforce Housing CAN Hold off the Blitz of a Recession Workforce Housing CAN Hold off the Blitz of a Recession With the abundance of #Recession buzz going around there’s no doubt, as Workforce Apartment Community Investors/Syndicators, we are ultraconservative, patient, and playing a serious game of defense when acquiring assets. We’re doing our due diligence, running the asset through a stress test, & confidently pressing forward with acquisitions that pass the exam. The high scoring offense (market appreciation) may be on borrowed time; however, Workforce Housing CAN withstand the blitz of a #Recession as we have an asset that’s pretty resilient. We’re buying defensively based on location, cash flow, conservative underwriting, management, and debt. We’re NOT alone on our predictions... Bendix Anderson, writer for The National Real Estate Investor notes... “The apartment sector is likely to hold up, according to industry experts!” Further, Andrew Rybczynski, senior consultant for CoStar Group Portfolio Strategy stated “Apartments are still resilient against a possible recession,” he says Demand is outpacing supply and “There’s no reason why the homeownership rate won’t fall further”. A downturn in the economy is more likely to drive people to affordable apartment communities (B & C Class) vs. buying a condo or house. To top it off, and make our choice of asset even more valuable and desirable, in December of 2018, CBRE reported only a small amount of workforce housing has been developed over the past 10yrs. Further, “many older apartment communities have been demolished to make way for high-end multifamily developments.” CBRE, notes “the multifamily industry removes more than 100,000 housing units each year. These are usually workforce and affordable units.” If you, like me, love ❤ this asset class, for a multitude of reasons, - it appears as if we’re in possession &/or pursuit of highly desirable, valuable, cash flowing, tax sheltered/deferred, & appreciating asset/investment. In conclusion, no investment is guaranteed; however, done correctly - historically speaking - this alternative investment carries a low risk profile, several unique tax benefits, and the ability to weather the storm. References: 1) https://www.nreionline.com/multifamily/us-apartment-sector-would-continue-remain-strong-even-recession 2) https://www.rejournals.com/workforce-housing-a-new-darling-of-investors-20181203 #Defense #FillANeed #Supply&Demand #Impact #CapitalPreservation #FiduciaryResponsibilities I hope you found this information helpful. Whether you are here for the education, entertainment, or If you, or someone you know, has a problem finding the right place to invest their money - please help them by sharing this info. I don’t have anything to sell BUT I AM on a mission and I will b

Next Episode

Edified Equity Podcast Episode 49: Joe Fairless BEST EVER Podcast Corporate Investor/Entrepreneur

Edified Equity Podcast Episode 49: Interview with Joe Fairless BEST EVER Podcast Corporate Investor/Entrepreneur Show Notes: Welcome to the Edified Equity Podcast! My Name’s Dino and Here we will focus on all of the unique Benefits associated with being a Passive Equity Investor in an Apartment Syndication. You can learn more about, and follow, us on the Web, iTunes, Stitcher, FB, YouTube, Linkedin, Instagram, & our Award Winning Blog on Bigger Pockets. All associated links will be in the show notes. If you Find this information Helpful Please Subscribe, Like, Comment, Rate & Review! Associated Links! Edified Equity Website: http://www.edifiedequity.com/ Edified Equity Podcast iTunes: https://apple.co/2EUPjvE Edified Equity Podcast Stitcher: http://www.stitcher.com/s?fid=185852&refid=stpr Edified Equity Facebook Group: https://www.facebook.com/groups/MultifamilyPassiveCashFlow// Edified Equity YouTube Channel: https://www.youtube.com/channel/UCiTMeHhVXIMgCujDzXTxkww LinkedIn: http://bit.ly/2EMd0WK Bigger Pockets Blog: https://www.biggerpockets.com/blogs/10726-benefits-multifamily-passive-investors LinkedIn: http://bit.ly/2EMd0WK Edified Equity Podcast Episode 49: Interview with Joe Fairless BEST EVER Podcast Corporate Investor/Entrepreneur Dino was raised by entrepreneurs, but took a little different path at first, going to and graduating from college before entering the corporate world. Once he was there, he wanted more, and to scratch that entrepreneurial itch! He started a few small ventures, before falling in love with real estate, specifically multifamily syndications. Hear how he jumped into the multifamily syndication business, and is teaming with others to grow the business. If you enjoyed today’s episode remember to subscribe in iTunes and leave us a review! Best Ever Tweet: “You can bring a deal to a team that is already experienced, chances are they’ll do it and add you to the GP side of the deal” – Dino Pierce Dino Pierce Real Estate Background: • CEO of Edified Equity and an Active Multifamily Investor • In 2018 Edified Equity and partners syndicated 4 apartment communities consisting of 254 doors, across 4 markets, valued at $9.3M • Based in Denver, CO • Say hi to him at https://www.edifiedequity.com/ • Best Ever Book: How to Win Friends and Influence People I hope you found this information helpful. Whether you are here for the education, entertainment, or If you, or someone you know, has a problem finding the right place to invest their money - please help them by sharing this info. I don’t have anything to sell BUT I AM on a mission and I will be delivering quality, consultative, educational, content on a routine basis! Thanks for Tuning in- Make it a great day - you certainly deserve it! This is Dino Pierce CEO of Edified Equity Signing off - Goodbye #biggerpockets #leadership #business #podcasting #relationships #multifamilyinvestments #impactinvesting #trust #costsegregation #apartments #syndication #equity #directinvestments #cashflow #appreciation #taxshelter #solo401kinvesting #selfdirectedira #passiveincome #alternativeinvestments #highnetworthindividuals #familyoffice #generationalwealth #trusts #privatemoney #privateequity #duediligence #realestate #realestateinvestor #realestatelife #realestateinvesting #legacy #legacyplanning #ROI #multifamily #multifamilyinvesting #investing #investor #investment #entrepreneur #entrepreneurlife #entrepreneurship #hardassets #apartments #apartmentinvesting #financialfreedom #gratitude #CIO #cheifinvestmentofficer #singlefamilyoffice #multifamilyoffice #wealthmanagement #RIA #billiondollarfamilyoffice #edifiedequity #bonusdepreciation

If you like this episode you’ll love

Episode Comments

Generate a badge

Get a badge for your website that links back to this episode

<a href="https://goodpods.com/podcasts/edified-equity-413502/edified-equity-podcast-episode-48-cap-rate-noi-and-valuation-57563634"> <img src="https://storage.googleapis.com/goodpods-images-bucket/badges/generic-badge-1.svg" alt="listen to edified equity podcast episode 48: cap rate, noi, and valuation on goodpods" style="width: 225px" /> </a>

Copy